Lusha vs. ZoomInfo: Which Is Better?

Try Cognism instead

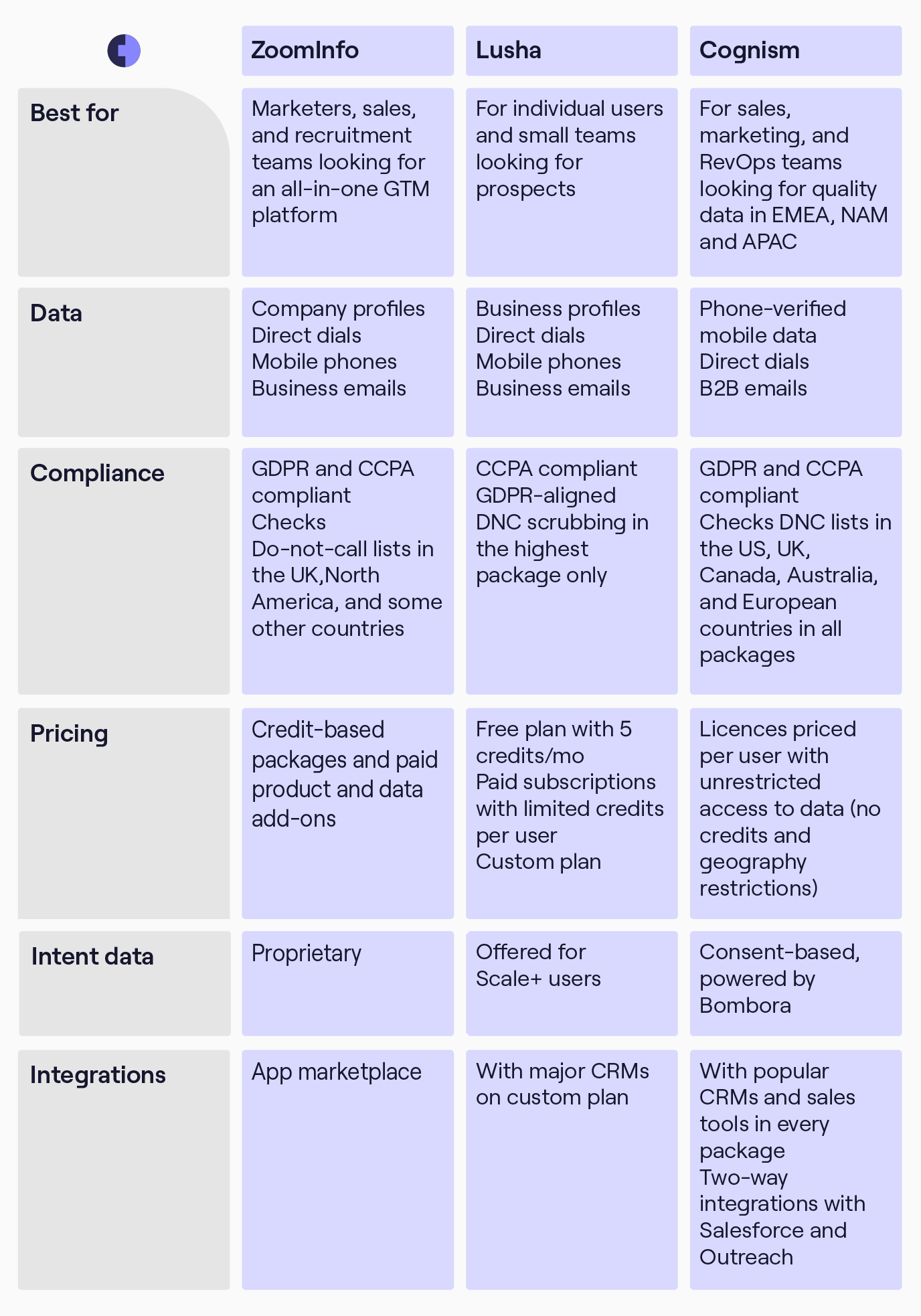

Before we dive into Lusha vs ZoomInfo comparison, check out the third option with:

- Best European data: Cognism has more contacts in Europe than other providers

- On of the largest mobile numbers database and verification service on request

- Manually-verified mobile data with 98% accuracy

- Unrestricted access to viewing and page-level exporting global data in all packages (subject to fair use)

- Global compliance: CCPA, GDPR, broader DNC lists scrubbing, notified emails

- Sales triggers and firmographics in every package

- Seamless integrations with your existing tech stack and workflows

- Intent data powered by Bombora

Book a call and sample our data 👇

What's on this page

Comparing Lusha's and ZoomInfo's data quantity

Businesses often want to know how many email addresses and direct phone numbers ZoomInfo and Lusha have.

ZoomInfo dominates the space with over 150 million email addresses and 50 million direct dials in its contact database. In comparison, Lusha offers more than 60 million emails and 50 million direct phone numbers to reach decision-makers.

In short, ZoomInfo has more emails than Lusha and the same number of direct dials.

But how does Cognism compare to ZoomInfo vs. Lusha?

Cognism is a world leader when it comes to mobile number coverage

Cognism has the most complete data in EMEA and is a leading provider of quality cell phone numbers in the US.

- 2x more cell phone numbers than other providers.

- 47 million cell phones in the US alone.

- Premium manually-verified cell phone dataset with 98% accuracy.

Looking for a global provider? We have coverage across EMEA, NAM, and APAC 👇

Find out why 1800+ revenue teams choose Cognism as their sales intelligence provider

Data quality

We can all agree that only accurate and up-to-date contact and company data helps SDRs and sales reps connect with decision-makers. And that’s where sales intelligence platforms, like Lusha and ZoomInfo, compete.

- Lusha uses a proprietary algorithm to filter unverified profiles to ensure reliable contact details. It also enriches the profiles with firmographic data and basic data types.

- ZoomInfo offers more robust and expansive company information and various advanced data-related products and services. For example, data enrichment features via traditional API to support large data needs and re-enrichment Webhooks that update contact information in real-time.

Despite their best efforts, no data provider is 100% correct in all areas. The data accuracy depends on a few variables, such as the industry or location. ZoomInfo and Lusha check the accuracy of their B2B contact databases in different ways. But ZoomInfo’s advanced features might be an overkill for smaller businesses looking to simply buy sales leads.

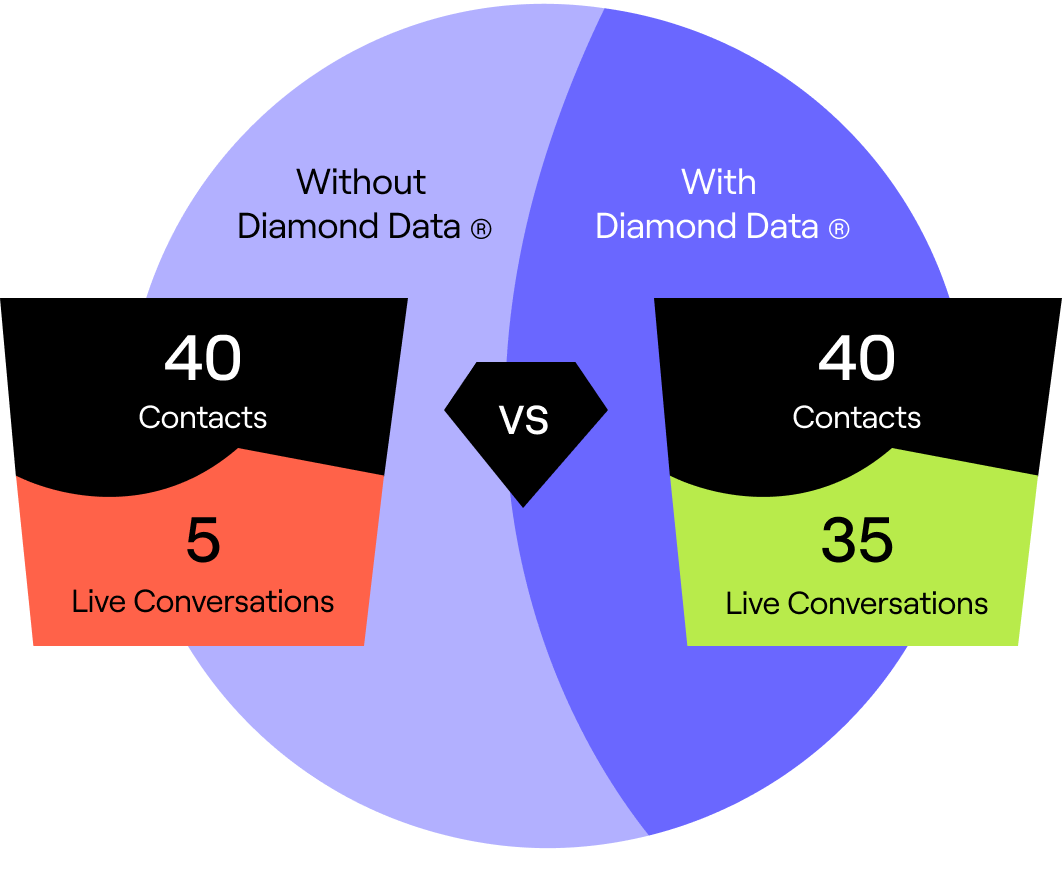

At Cognism, we invest in Diamond Data®—our exclusive mobile data asset comprising 98% accurate, phone-verified mobiles, while most providers offer 60-80% correct phone data. We introduced human verification on top of our already stringent data verification process to ensure you reach the right prospects, in their current roles, at the correct companies.

If the prospect is not yet verified, you have the option to request us to verify it for you.Listen to Verche Karafiloska, our Head of Product Marketing, to learn how achieving this level of accuracy is possible 👇

More results from fewer calls

Our team confirms the accuracy of your prospects' cell phone numbers—so that when you call, they pick up.

- Phone-verified contact data

- 98% accurate

-

Complete GDPR compliance

- Multiple filters to unearth and prioritise high-value prospects

GDPR and CCPA compliance

ZoomInfo has a long history of ensuring compliance with CCPA and GDPR. Lusha is CCPA compliant and has recently announced GDPR compliance. DNC list scrubbing is only available in Lusha's highest package.

CCPA is a California-wide data-privacy law that regulates how businesses handle the personal information of the state residents. And GDPR is the most rigid privacy and security law in the world passed by the EU.

Failing to comply with the rules can have severe implications for your business.

If compliant data is your number one priority, Cognism has the edge over ZoomInfo and Lusha.

On top of being CCPA and GDPR compliant, we check:

- DNC lists in the USA, Canada, and Australia

We're the only provider that focuses on checking so many European DNC lists, including:

- TPS/CTPS in the UK

- DNCs in Germany, France, Spain, Ireland, Belgium, Croatia, Portugal, and Sweden

We do not collect B2C email addresses; this removes the risk from our customers. We also notify our B2B database and ensure every email you get through the platform is a business email.

“Our legal team reviewed ZoomInfo’s GDPR standards in Europe, and they were not up to scratch. As a result, they removed the European team’s access to the platform, which massively impacted our sales output.”

Pierre Bourguignon, SDR Manager at Cloudreach

ZoomInfo vs. Lusha's Pricing

Lusha’s pricing is based on credits per user. You simply get what you pay for—the features and number of records you can reveal and export depend on your subscription. Packages for small businesses range from a free Starter plan with five credits per user a month to $29 and $51/mo per user with a limited number of credits. You can cancel your plan anytime.

If you're a 5+ team or an advanced user who needs integrations to CRM and SSO, you'll need to opt-in for the custom plan.

ZoomInfo's licence pricing is more complex than Lusha’s and is only available after a consultation. It offers packages for recruiters, sales and marketing, customised solutions with integrations, segmentation features, and different data points as add-ons. Unlike Lusha, ZoomInfo doesn’t offer monthly plans.

Lusha is more affordable than ZoomInfo, and its pricing is revealed upfront for smaller users. Both providers rely on credit-based models, which usually limit data views and exports. It may lead to paying unexpected fees for extra data, and teams may get worried about wasting credits.

If you find ZoomInfo’s platform too expensive, but Lusha’s doesn’t meet your needs to scale or operate more efficiently, other products will get the job done at an attractive price point.

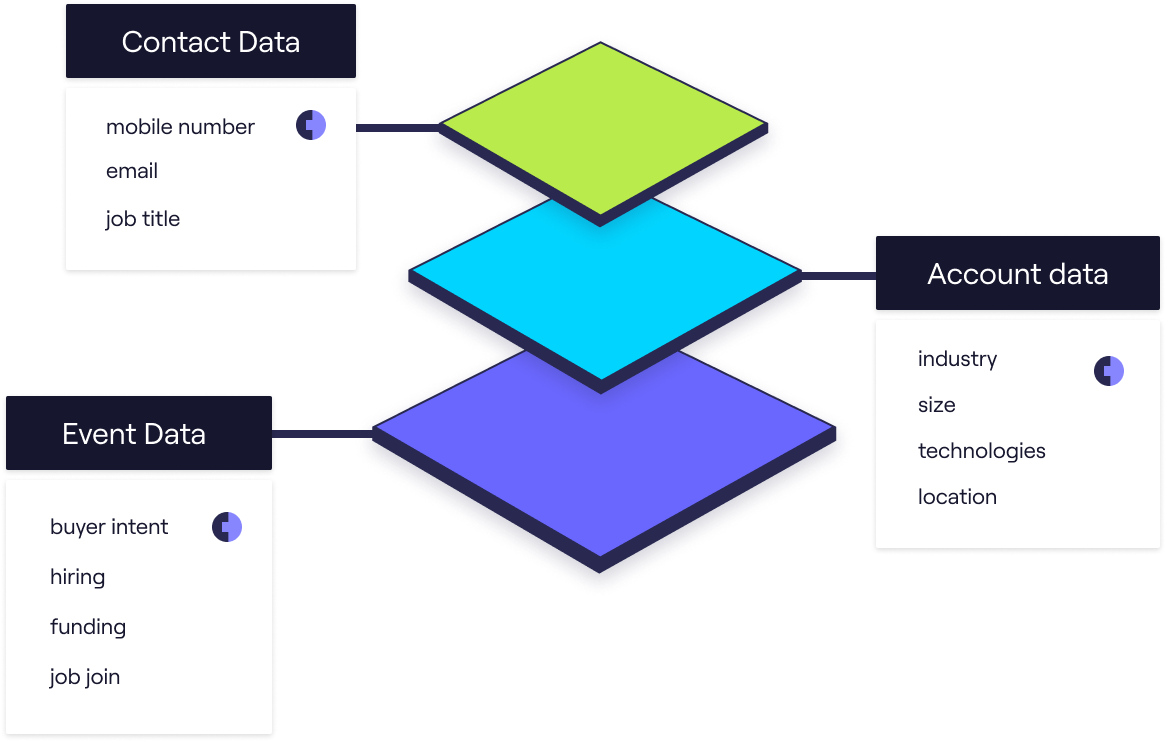

If you’re looking for unlimited prospecting, check out Cognism. All Cognism packages include:

- Unrestricted views, individual and page-level exporting

- Contact, firmographic, technographic data, and sales trigger events

- CRM/sales engagement tools integrations

Additionally, users can add intent data and mobile phone verification on-demand to their package.

Cognism also offers packages for list-building workflows used by marketing and operations teams.

Find out why 1800+ revenue teams choose Cognism as their sales intelligence provider

Intent data

Intent data helps connect with buyers who are in-market earlier in their buyer journey. ZoomInfo and Lusha provide intent data from two different sources.

ZoomInfo leverages proprietary machine-learning technology to engage sales leads based on buying signals. ZoomInfo gathers intent data from a variety of sources and it’s believed Zoominfo relies on bidstream data. It is available within the ZoomInfo Powered by DiscoverOrg platform.

According to Lusha’s pricing page, intent signals are offered for Scale+ users.

Cognism partners with Bombora’s intent data because they collect constant-based data, and 70% of it is exclusive to Bombora. It comes from a collaborative network of 5000 of the world's best publishers where B2B buyers do their research.

Another thing that sets Bombora apart from other intent data providers is the historical baseline used when calculating intent.

The baseline takes into consideration typical content consumption in a given company. That means that only interaction above typical consumption shows buyer intent.

Lusha vs. ZoomInfo Integrations

Lusha's integrations, when compared to ZoomInfo’s, are limited. Lusha integrates with a few major CRMs, whereas ZoomInfo has a marketplace with 10 CRMs, and you can browse apps in different categories.

In comparison, ZoomInfo has an app marketplace and adds new apps to its tech stack. It contains all of Lusa's integrations and more.

If your team uses best-in-class solutions, like Salesloft and Outreach, don’t overlook Cognism. We’re investing in building robust integrations and workflows.

We offer two-way integrations with Salesforce to help users prospect into their owned accounts and find the right person quicker. It means you can instantly see whether a record already exists in your database. It saves a lot of time and work.

Cognism Chrome Extension is a game-changer in the SDR world. It works over Outreach, Salesforce, and HubSpot so that you can enrich prospect records without leaving the tools.

Look how easy it is 👉

Find out why 1800+ revenue teams choose Cognism as their sales intelligence provider

“The integrations between Salesforce, Outreach and Cognism are flawless. The ability to find a prospect, click the contact, redeem the contact details and export the information straight into Salesforce ready for Outreach is revolutionary for an SDR.”

Sam Butcher, Senior Partnerships Manager at SIA

FAQ

We're answering your most common questions about the differences between ZoomInfo and Lusha 👇

When comparing Zoominfo vs. Lusha features, such as contact data quality, coverage, and compliance, ZoomInfo is generally regarded as better than Lusha. Lusha is a much younger company than its competitor and hasn’t developed the volume of the accuracy of data that matches ZoomInfo’s.

Another advantage that ZoomInfo has over cheaper solutions, like Lusha or Apollo.io, is that it offers advanced sales intelligence capabilities like CRM integrations, lead capturing, and market intelligence that make qualifying leads easier and faster.

Find out what questions to ask data providers to make an informed decision.

The main difference between Lusha and ZoomInfo lies in the availability of low-commitment subscription packages for different business sizes, including small startups. Lusha's users can register, start using the platform, and upgrade when they scale.

On the other hand, ZoomInfo positions itself as a GTM platform for businesses; its features and pricing are optimized for larger teams and enterprises.

Lusha is generally considered easier to use and set up because it lacks ZoomInfo’s advanced platform functionality. It also prides itself on being a self-service model. The amount of ZoomInfo features and products make the platform harder to adopt. ZoomInfo offers first-time users “ZoomInfo University” to help them implement the solution.

Cognism, ZoomInfo, and Lusha offer Chrome browser extensions that allow users to access a prospect’s contact details and company profiles instantly and enrich Sales Nav records.

Cognism Chrome extension is the best one available because it lets users enrich contacts with verified mobile phone numbers. Cognism’s mobile database is the largest at the moment.

ZoomInfo Chrome extension not working? Check out how to fix it.

Cognism has better coverage of mobile numbers than ZoomInfo and offers the best in class data quality thanks to Diamond Data®. It is an exclusive mobile data asset comprising 98% accurate, phone-verified mobiles (meaning our team calls the numbers to confirm the right person answers).

Most other providers offer 60-80% accurate phone data. Cognism is also a B2B data provider with strong EU coverage and guarantees global data compliance.

Cognism seamlessly integrates with leading solutions to blend with your existing tech stack and workflows. So it's a better option for companies that are not looking to replace their workflows with ZoomInfo's products.

We knew you'd ask, so we ran some tests!

In general, connect rate depends on the data type you're using (switchboards, direct office numbers, or mobiles) and the region you're targeting.

We've tested Diamond Data® multiple times and seen it help users 5x their reach and 7x their connect rates.

Here are the results from our recent half-day sales call blitz, where our salespeople used Cognism's Diamond Data® and Ryan Reisert's Phone Ready Leads™.

Some companies that use ZoomInfo or Lusha in the US turn to Cognism when their SDRs suffer from list fatigue or a gap in coverage.

Usually, these are companies headquartered in the US whose regional VPs come to Cognism because the European team needs more coverage from their existing provider.

And then, there's GDPR. Compliance laws are much stricter in Europe, so European teams choose Cognism, which is known for its commitment to GDPR.

All data providers excel in certain areas. You don't have to stick with ZoomInfo or Lusha on an organisational level.

Companies choose multiple providers across all regions and offices depending on their coverage and quality requirements.

Depending on the size of your team, the scale of your outbound engine, and your budget, you may be looking for a secondary provider to serve your international teams and offices.

The single provider approach

One provider for all teams

Depending on the size of your team, the scale of your outbound engine, and your budget, you may be looking for a single provider, like Lusha or ZoomInfo, to serve all your teams and offices (if you have an international presence).

Usually, customers who fall into this category:

- have historically been using a list broker and are now looking for scalability, bigger autonomy, and better data quality

- have a sales intelligence provider in place but are suffering from list fatigue (connect rates have suddenly dropped) or a gap in coverage

Looking for a global provider? We have coverage across EMEA, NAM, and APAC.

Find out why 1800+ revenue teams choose Cognism as their sales intelligence provider

The regional provider approach

One provider for each of your offices

We have a number of clients who use Cognism in the UK and Zoominfo or Lusha in the US.

Usually, these are companies headquartered in the US whose regional VPs come to Cognism because the European team doesn't get sufficient coverage from their existing provider.

And then, there's GDPR. With compliance laws much stricter in Europe, European teams need a trusted provider known for their commitment to GDPR.

Is EMEA expansion keeping you up at night? We can give your European team actionable, compliant data.

Find out why 1800+ revenue teams choose Cognism as their sales intelligence provider

The complementary approach

Primary + supporting provider(s)

Finally, the third option is having multiple providers across all regions/offices.

Customers that have this setup in place usually end up choosing a primary provider that's the main source of data (depending on their coverage and quality requirements), and fill the gaps using data from other providers.

Is a piece missing in your data puzzle?

Find out why 1800+ revenue teams choose Cognism as their sales intelligence provider

What brands choose Cognism?

.png)